Life Insurance in and around Columbia

Insurance that helps life's moments move on

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

Check Out Life Insurance Options With State Farm

If you are young and newly married, it's the perfect time to talk with State Farm Agent Phyllis Nichols about life insurance. That's because once you buy a home or condo, you'll want to be ready if tragedy strikes.

Insurance that helps life's moments move on

Life won't wait. Neither should you.

Put Those Worries To Rest

One of the ideal times to get Life insurance can be when you're just starting out. Whether you decide to go with level or flexible payments with coverage to last a lifetime coverage for a specific time frame or another coverage option, State Farm agent Phyllis Nichols can help you with a policy that works for you.

No matter where you are in life, you're still a person who could need life insurance. Reach out to State Farm agent Phyllis Nichols's office to determine the options that are right for you and those you hold dear.

Have More Questions About Life Insurance?

Call Phyllis at (573) 443-8727 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Why go paperless and engage digitally?

Why go paperless and engage digitally?

Customers are moving more towards receiving communications digitally. We'll explain what that could mean to you.

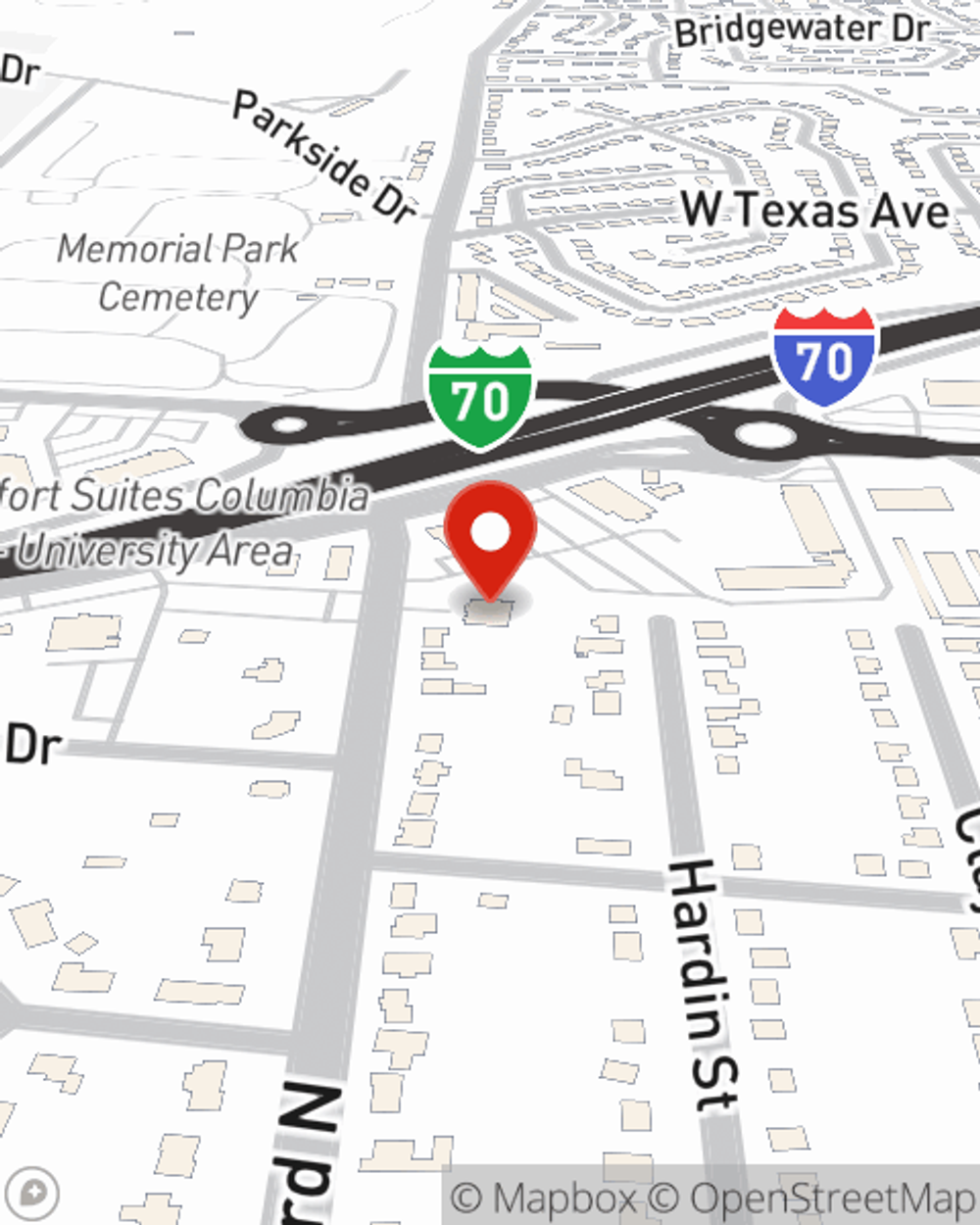

Phyllis Nichols

State Farm® Insurance AgentSimple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Why go paperless and engage digitally?

Why go paperless and engage digitally?

Customers are moving more towards receiving communications digitally. We'll explain what that could mean to you.